FY 2017 First Quarter Earnings Call

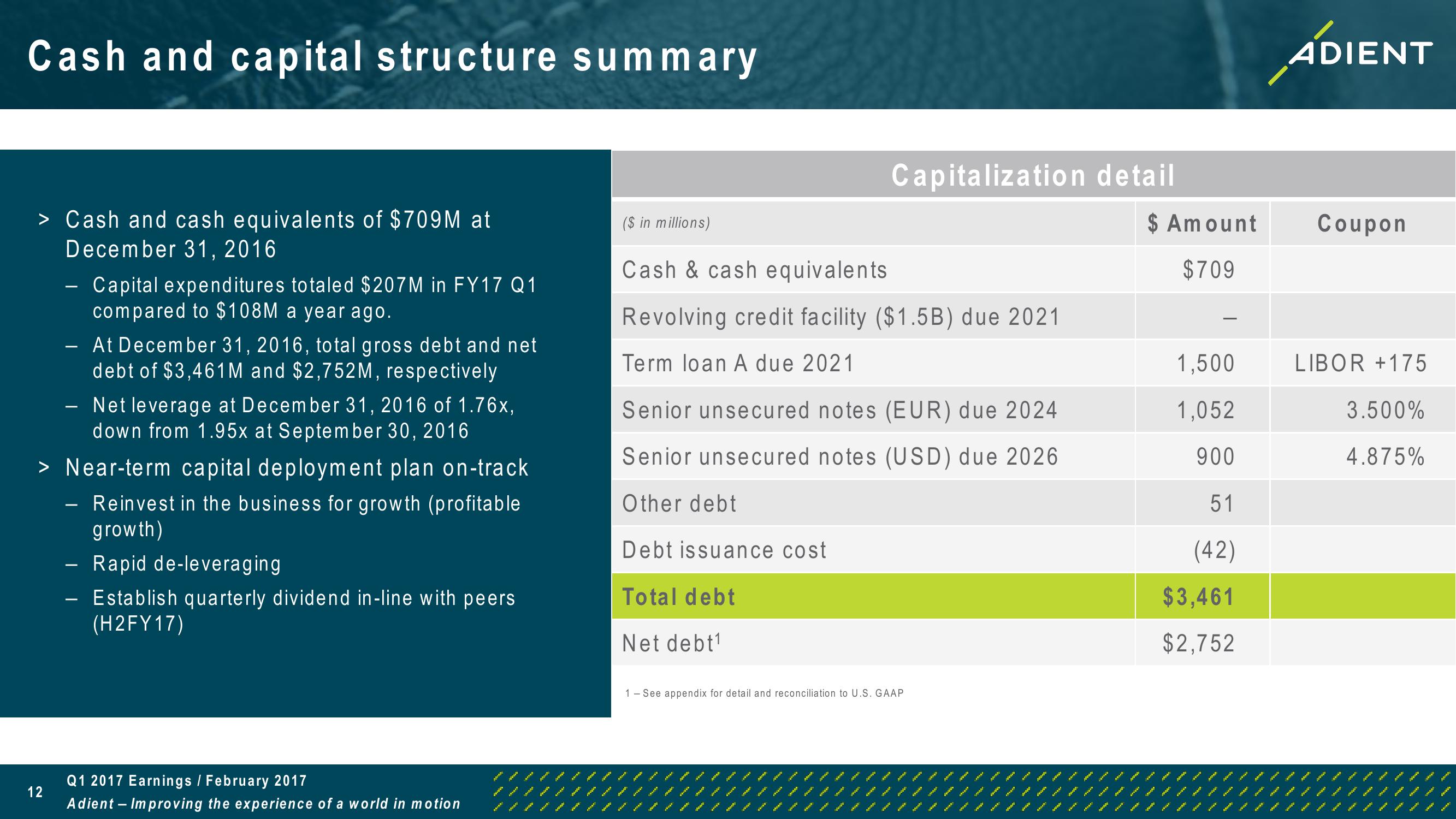

Cash and capital structure summary

12

ADIENT

> Cash and cash equivalents of $709M at

December 31, 2016

-

-

Capital expenditures totaled $207M in FY17 Q1

compared to $108M a year ago.

At December 31, 2016, total gross debt and net

debt of $3,461M and $2,752M, respectively

- Net leverage at December 31, 2016 of 1.76x,

down from 1.95x at September 30, 2016

Capitalization detail

($ in millions)

$ Amount

Coupon

Cash & cash equivalents

$709

Revolving credit facility ($1.5B) due 2021

Term loan A due 2021

1,500

LIBOR +175

> Near-term capital deployment plan on-track

- Reinvest in the business for growth (profitable

growth)

Senior unsecured notes (EUR) due 2024

Senior unsecured notes (USD) due 2026

Other debt

1,052

3.500%

900

4.875%

51

Debt issuance cost

(42)

-

Rapid de-leveraging

Establish quarterly dividend in-line with peers

(H2FY17)

Total debt

$3,461

Net debt1

$2,752

Q1 2017 Earnings / February 2017

Adient - Improving the experience of a world in motion

1 See appendix for detail and reconciliation to U.S. GAAPView entire presentation