OpenText Investor Presentation Deck

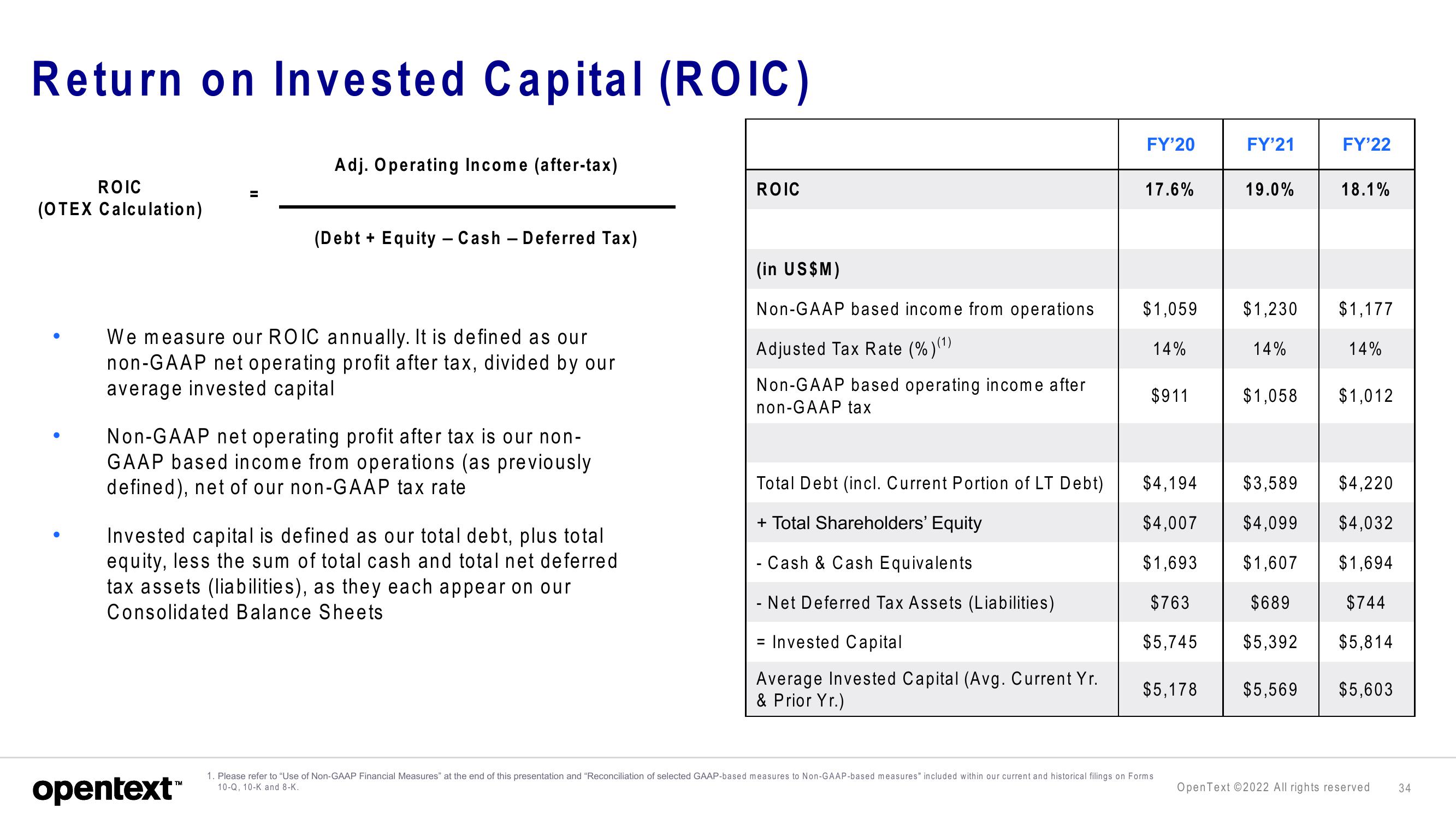

Return on Invested Capital (ROIC)

ROIC

(OTEX Calculation)

Adj. Operating Income (after-tax)

(Debt + Equity - Cash Deferred Tax)

We measure our ROIC annually. It is defined as our

non-GAAP net operating profit after tax, divided by our

average invested capital

Non-GAAP net operating profit after tax is our non-

GAAP based income from operations (as previously

defined), net of our non-GAAP tax rate

opentext™

Invested capital is defined as our total debt, plus total

equity, less the sum of total cash and total net deferred

tax assets (liabilities), as they each appear on our

Consolidated Balance Sheets

ROIC

(in US$M)

Non-GAAP based income from operations

Adjusted Tax Rate (%)(¹)

Non-GAAP based operating income after

non-GAAP tax

Total Debt (incl. Current Portion of LT Debt)

+ Total Shareholders' Equity

- Cash & Cash Equivalents

- Net Deferred Tax Assets (Liabilities)

= Invested Capital

Average Invested Capital (Avg. Current Yr.

& Prior Yr.)

FY'20

17.6%

$1,059

14%

$911

FY'21

19.0%

1. Please refer to "Use of Non-GAAP Financial Measures" at the end of this presentation and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current and historical filings on Forms

10-Q, 10-K and 8-K.

$1,230

14%

$1,058

$4,194

$3,589

$4,007

$4,099

$1,693

$1,607

$763

$689

$5,745 $5,392

FY'22

18.1%

$1,177

14%

$1,012

$4,220

$4,032

$1,694

$744

$5,814

$5,178 $5,569 $5,603

OpenText ©2022 All rights reserved 34View entire presentation