AngloAmerican Results Presentation Deck

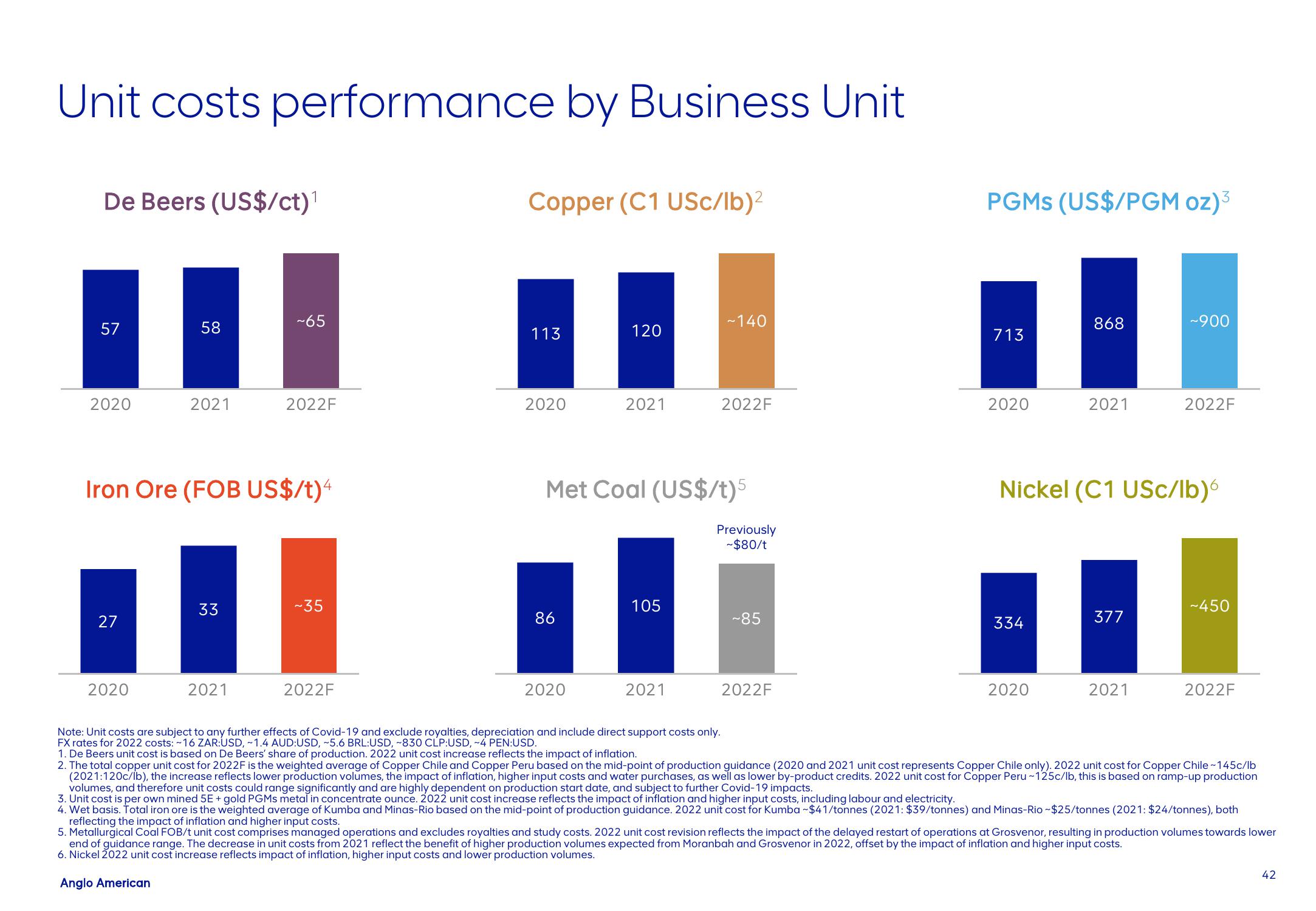

Unit costs performance by Business Unit

De Beers (US$/ct)¹

57

2020

27

58

2020

2021

Iron Ore (FOB US$/t)4

33

~65

2021

2022F

~35

2022F

Copper (C1 USC/lb)²

113

2020

86

120

2020

2021

Met Coal (US$/t)5

105

~140

2021

2022F

Previously

-$80/t

~85

2022F

PGMs (US$/PGM oz)³

713

2020

334

868

2020

2021

Nickel (C1 USC/lb)

377

~900

2021

2022F

~450

2022F

Note: Unit costs are subject to any further effects of Covid-19 and exclude royalties, depreciation and include direct support costs only.

FX rates for 2022 costs: ~16 ZAR:USD, ~1.4 AUD:USD, ~5.6 BRL:USD, ~830 CLP:USD, ~4 PEN:USD.

1. De Beers unit cost is based on De Beers' share of production. 2022 unit cost increase reflects the impact of inflation.

2. The total copper unit cost for 2022F is the weighted average of Copper Chile and Copper Peru based on the mid-point of production guidance (2020 and 2021 unit cost represents Copper Chile only). 2022 unit cost for Copper Chile~145c/lb

(2021:120c/lb), the increase reflects lower production volumes, the impact of inflation, higher input costs and water purchases, as well as lower by-product credits. 2022 unit cost for Copper Peru ~125c/lb, this is based on ramp-up production

volumes, and therefore unit costs could range significantly and are highly dependent on production start date, and subject to further Covid-19 impacts.

3. Unit cost is per own mined 5E + gold PGMs metal in concentrate ounce. 2022 unit cost increase reflects the impact of inflation and higher input costs, including labour and electricity.

4. Wet basis. Total iron ore is the weighted average of Kumba and Minas-Rio based on the mid-point of production guidance. 2022 unit cost for Kumba-$41/tonnes (2021: $39/tonnes) and Minas-Rio-$25/tonnes (2021: $24/tonnes), both

reflecting the impact of inflation and higher input costs.

5. Metallurgical Coal FOB/t unit cost comprises managed operations and excludes royalties and study costs. 2022 unit cost revision reflects the impact of the delayed restart of operations at Grosvenor, resulting in production volumes towards lower

end of guidance range. The decrease in unit costs from 2021 reflect the benefit of higher production volumes expected from Moranbah and Grosvenor in 2022, offset by the impact of inflation and higher input costs.

6. Nickel 2022 unit cost increase reflects impact of inflation, higher input costs and lower production volumes.

Anglo American

42View entire presentation