Kore Results Presentation Deck

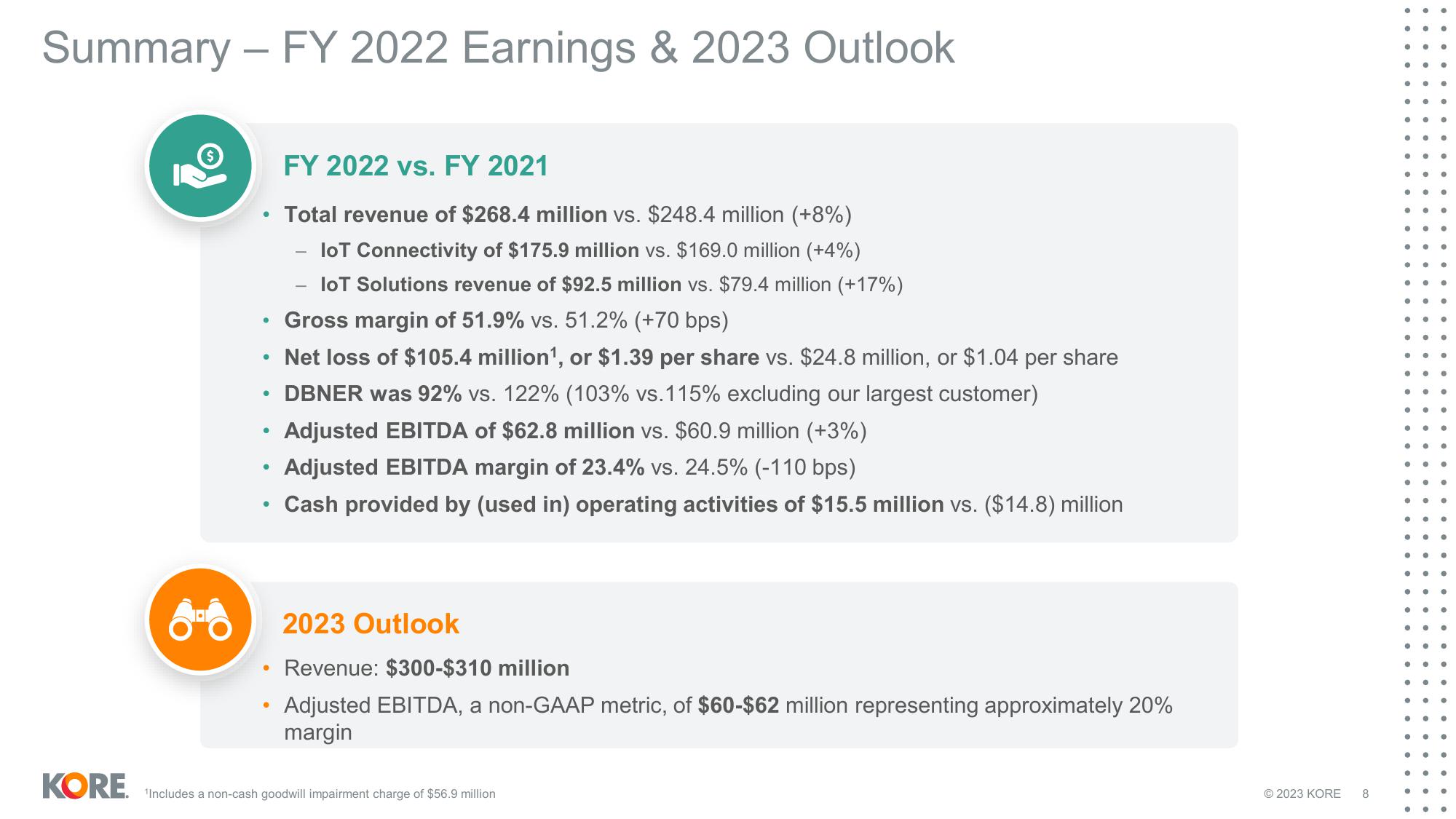

Summary - FY 2022 Earnings & 2023 Outlook

8

●

●

●

●

●

●

●

FY 2022 vs. FY 2021

Total revenue of $268.4 million vs. $248.4 million (+8%)

IoT Connectivity of $175.9 million vs. $169.0 million (+4%)

loT Solutions revenue of $92.5 million vs. $79.4 million (+17%)

Gross margin of 51.9% vs. 51.2% (+70 bps)

Net loss of $105.4 million¹, or $1.39 per share vs. $24.8 million, or $1.04 per share

DBNER was 92% vs. 122% (103% vs.115% excluding our largest customer)

Adjusted EBITDA of $62.8 million vs. $60.9 million (+3%)

Adjusted EBITDA margin of 23.4% vs. 24.5% (-110 bps)

Cash provided by (used in) operating activities of $15.5 million vs. ($14.8) million

2023 Outlook

Revenue: $300-$310 million

Adjusted EBITDA, a non-GAAP metric, of $60-$62 million representing approximately 20%

margin

KORE ¹Includes a non-cash goodwill impairment charge of $56.9 million

© 2023 KORE

8

●

●

●

●

●

●

●

● ●

●

●

●

..

●

●●

●

●

● ●

●

.

● ●

●

●

●

● ●

●

●

•

● ●

●

e

●

●View entire presentation