Opendoor Investor Presentation Deck

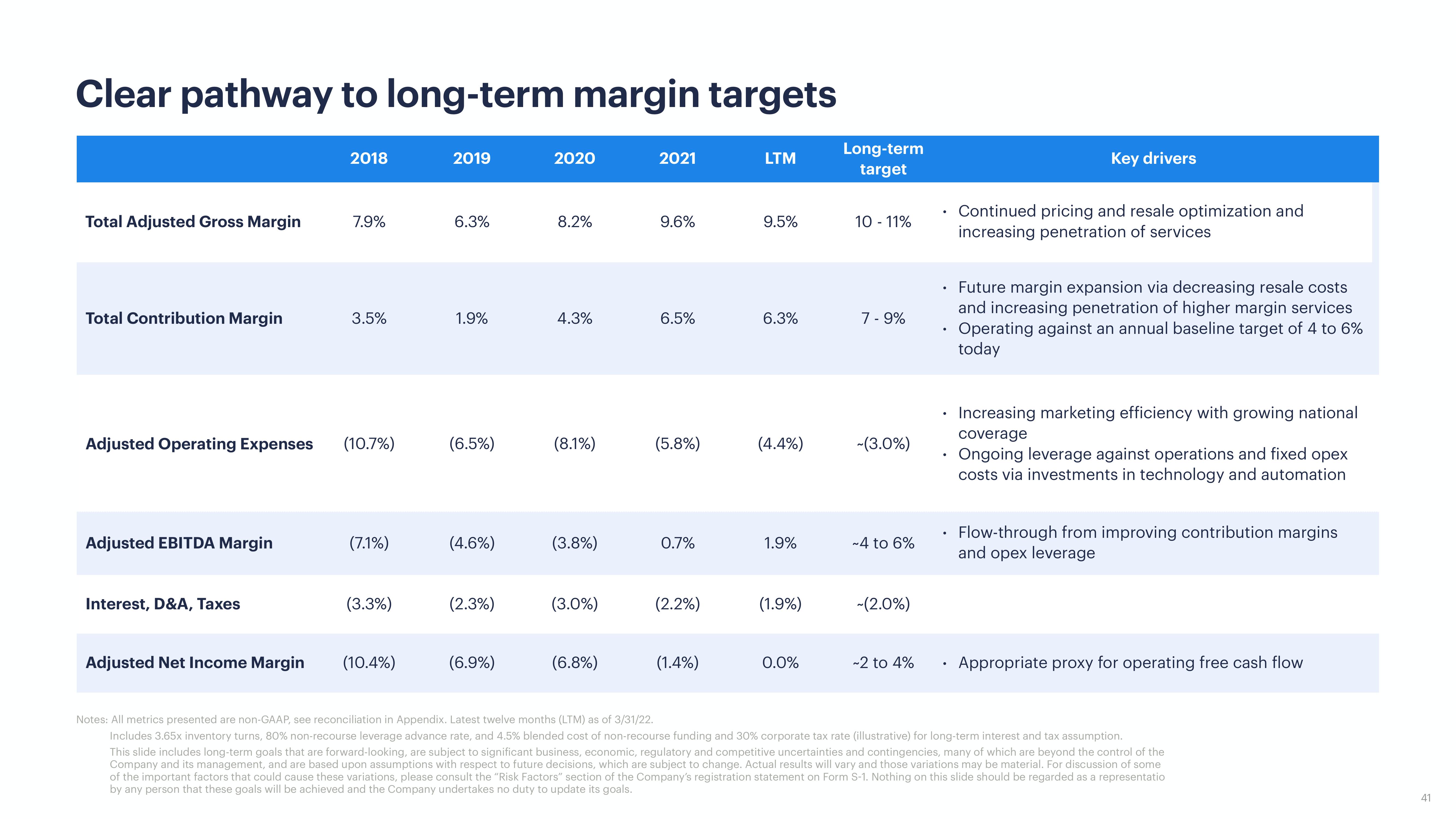

Clear pathway to long-term margin targets

Total Adjusted Gross Margin

Total Contribution Margin

Adjusted Operating Expenses

Adjusted EBITDA Margin

Interest, D&A, Taxes

Adjusted Net Income Margin

2018

7.9%

3.5%

(10.7%)

(7.1%)

(3.3%)

(10.4%)

2019

6.3%

1.9%

(6.5%)

(4.6%)

(2.3%)

(6.9%)

2020

8.2%

4.3%

(8.1%)

(3.8%)

(3.0%)

(6.8%)

2021

9.6%

6.5%

(5.8%)

0.7%

(2.2%)

(1.4%)

LTM

9.5%

6.3%

(4.4%)

1.9%

(1.9%)

0.0%

Long-term

target

10 - 11%

7 - 9%

-(3.0%)

-4 to 6%

~(2.0%)

~2 to 4%

.

.

.

Key drivers

Continued pricing and resale optimization and

increasing penetration of services

Future margin expansion via decreasing resale costs

and increasing penetration of higher margin services

Operating against an annual baseline target of 4 to 6%

today

Increasing marketing efficiency with growing national

coverage

Ongoing leverage against operations and fixed opex

costs via investments in technology and automation

Flow-through from improving contribution margins

and opex leverage

Appropriate proxy for operating free cash flow

Notes: All metrics presented are non-GAAP, see reconciliation in Appendix. Latest twelve months (LTM) as of 3/31/22.

Includes 3.65x inventory turns, 80% non-recourse leverage advance rate, and 4.5% blended cost of non-recourse funding and 30% corporate tax rate (illustrative) for long-term interest and tax assumption.

This slide includes long-term goals that are forward-looking, are subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the

Company and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. For discussion of some

of the important factors that could cause these variations, please consult the "Risk Factors" section of the Company's registration statement on Form S-1. Nothing on this slide should be regarded as a representatio

by any person that these goals will be achieved and the Company undertakes no duty to update its goals.

41View entire presentation