Baird Investment Banking Pitch Book

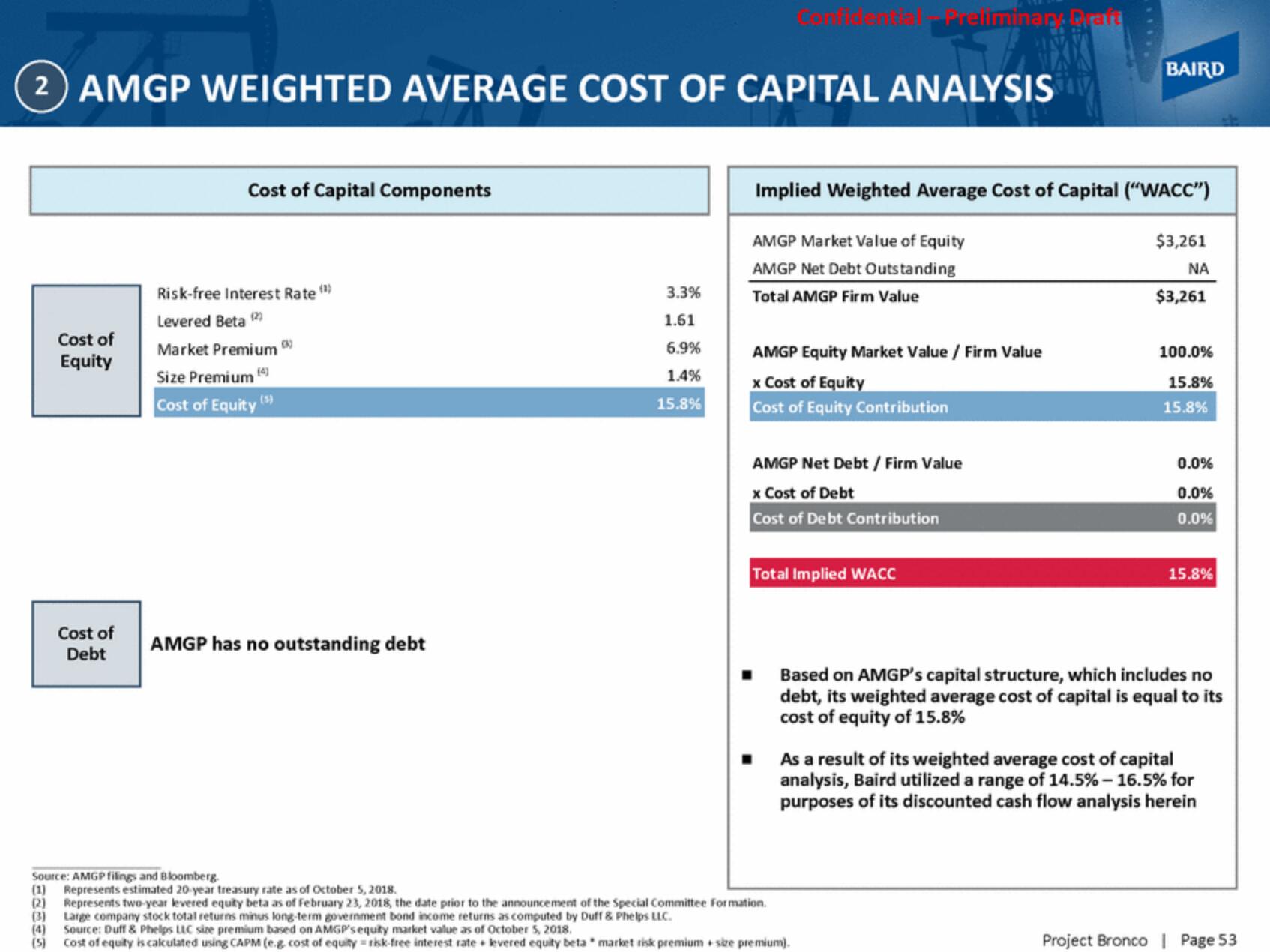

2) AMGP WEIGHTED AVERAGE COST OF CAPITAL ANALYSIS

(2)

(3)

Cost of

Equity

(4)

(5)

Cost of

Debt

Cost of Capital Components

Risk-free Interest Rate (¹)

Levered Beta (2)

Market Premium

Size Premium

Cost of Equity (5)

AMGP has no outstanding debt

3.3%

1.61

6.9%

1.4%

15.8%

reliminary Pratt

Implied Weighted Average Cost of Capital ("WACC")

AMGP Market Value of Equity

AMGP Net Debt Outstanding

Total AMGP Firm Value

AMGP Equity Market Value / Firm Value

x Cost of Equity

Cost of Equity Contribution

AMGP Net Debt / Firm Value

x Cost of Debt

Cost of Debt Contribution

Total Implied WACC

Source: AMGP filings and Bloomberg.

(1) Represents estimated 20-year treasury rate as of October 5, 2018.

Represents two-year levered equity beta as of February 23, 2018, the date prior to the announcement of the Special Committee Formation.

Large company stock total returns minus long-term government bond income returns as computed by Duff & Phelps LLC.

Source: Duff & Phelps LLC size premium based on AMGP'sequity market value as of October 5, 2018.

Cost of equity is calculated using CAPM (e.g. cost of equity risk-free interest rate levered equity beta market risk premium+ size premium).

BAIRD

$3,261

ΝΑ

$3,261

100.0%

15.8%

15.8%

0.0%

0.0%

0.0%

15.8%

Based on AMGP's capital structure, which includes no

debt, its weighted average cost of capital is equal to its

cost of equity of 15.8%

■ As a result of its weighted average cost of capital

analysis, Baird utilized a range of 14.5% -16.5% for

purposes of its discounted cash flow analysis herein

Project Bronco | Page 53View entire presentation