Pershing Square Activist Presentation Deck

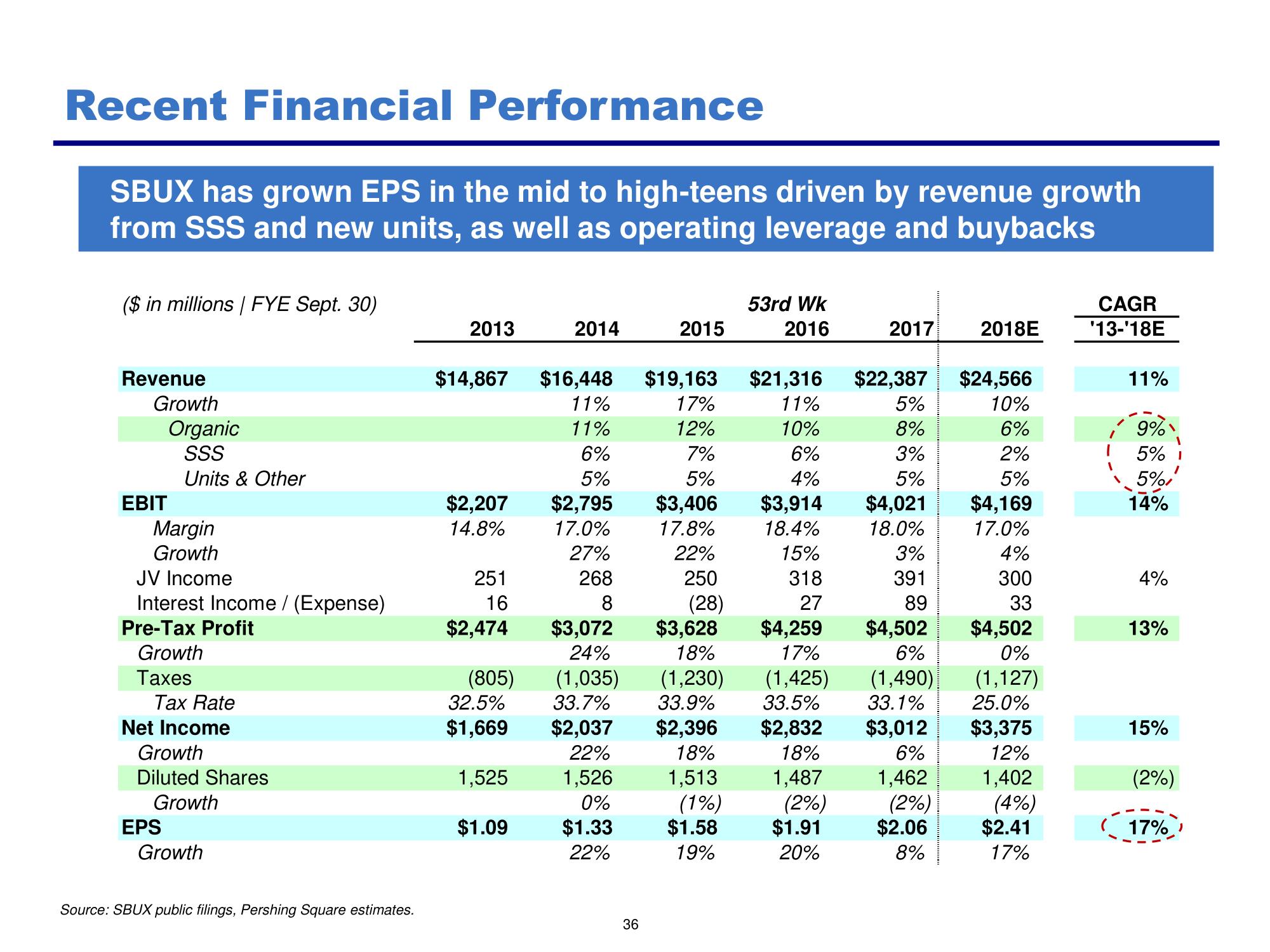

Recent Financial Performance

SBUX has grown EPS in the mid to high-teens driven by revenue growth

from SSS and new units, as well as operating leverage and buybacks

($ in millions | FYE Sept. 30)

Revenue

Growth

EBIT

Organic

SSS

Units & Other

Margin

Growth

JV Income

Interest Income / (Expense)

Pre-Tax Profit

Growth

Taxes

Tax Rate

Net Income

Growth

Diluted Shares

Growth

EPS

Growth

Source: SBUX public filings, Pershing Square estimates.

2013

$2,207

14.8%

251

16

$2,474

$14,867 $16,448 $19,163 $21,316

11%

17%

11%

11%

12%

10%

6%

7%

6%

5%

5%

4%

(805)

32.5%

$1,669

1,525

2014

$1.09

$2,795

17.0%

27%

268

8

$3,072

24%

(1,035)

33.7%

$2,037

22%

1,526

0%

$1.33

22%

2015

36

$3,406

17.8%

22%

250

(28)

$3,628

18%

(1,230)

33.9%

$2,396

18%

1,513

53rd Wk

2016

(1%)

$1.58

19%

$3,914

18.4%

15%

318

27

$4,259

17%

(1,425)

33.5%

$2,832

18%

1,487

(2%)

$1.91

20%

2017

$22,387 $24,566

10%

6%

2%

5%

5%

8%

3%

5%

$4,021

18.0%

3%

391

89

2018E

$2.06

8%

$4,169

17.0%

4%

300

33

$4,502

$4,502

6%

0%

(1,490)

(1,127)

33.1%

25.0%

$3,012 $3,375

6%

12%

1,462

1,402

(2%)

(4%)

$2.41

17%

CAGR

'13-'18E

1

"

11%

9%

5%

5%

14%

4%

13%

15%

1

(2%)

17%View entire presentation