OpenText Investor Presentation Deck

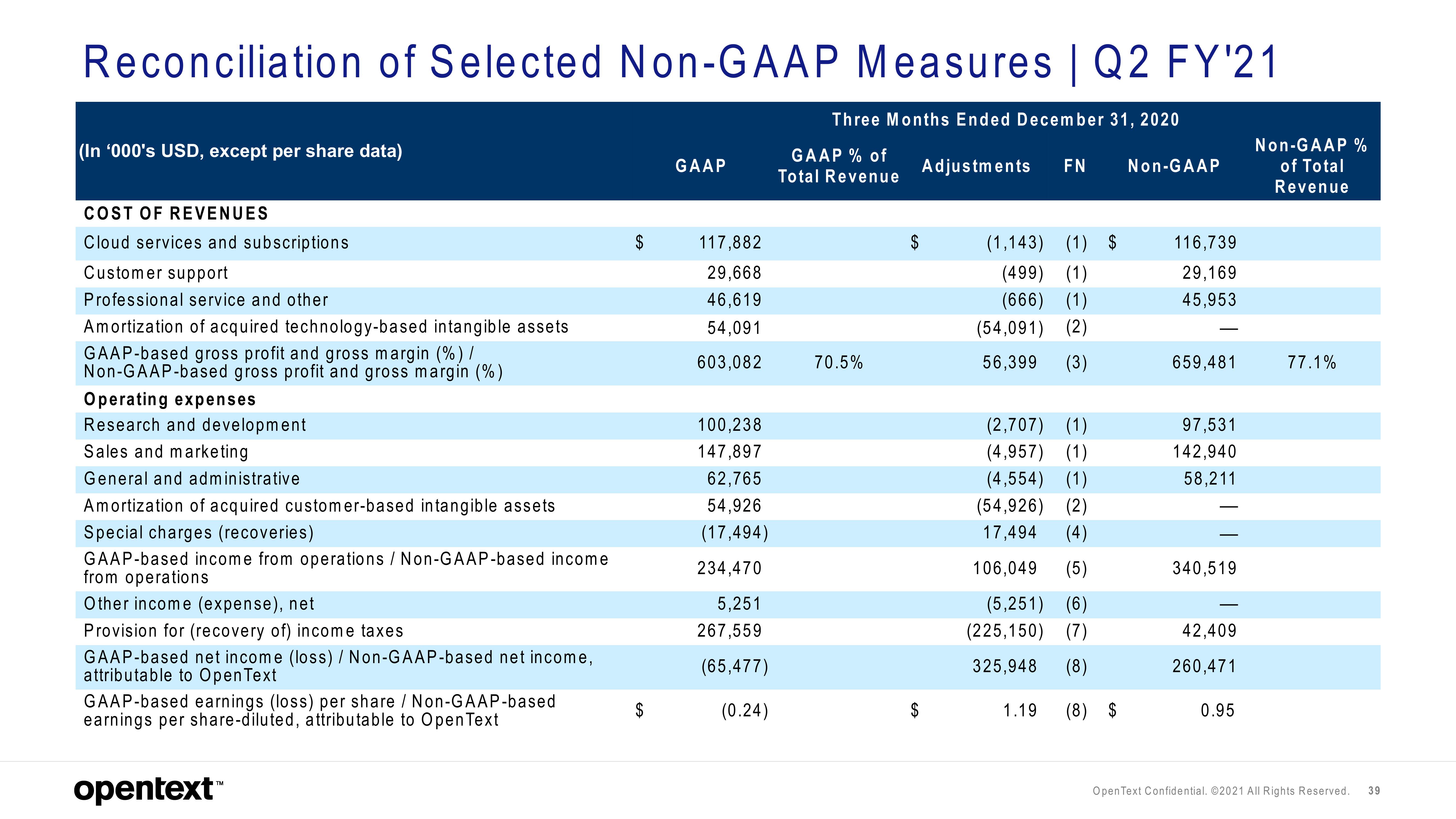

Reconciliation of Selected Non-GAAP Measures | Q2 FY'21

(In '000's USD, except per share data)

COST OF REVENUES

Cloud services and subscriptions

Customer support

Professional service and other

Amortization of acquired technology-based intangible assets

GAAP-based gross profit and gross margin (%) /

Non-GAAP-based gross profit and gross margin (%)

Operating expenses

Research and development

Sales and marketing

General and administrative

Amortization of acquired customer-based intangible assets

Special charges (recoveries)

GAAP-based income from operations / Non-GAAP-based income

from operations

Other income (expense), net

Provision for (recovery of) income taxes

GAAP-based net income (loss) / Non-GAAP-based net income,

attributable to Open Text

GAAP-based earnings (loss) per share / Non-GAAP-based

earnings per share-diluted, attributable to Open Text

opentext™

GAAP

117,882

29,668

46,619

54,091

603,082

100,238

147,897

62,765

54,926

(17,494)

234,470

5,251

267,559

(65,477)

(0.24)

Three Months Ended December 31, 2020

GAAP % of

Total Revenue

70.5%

$

Adjustments FN

(1,143) (1) $

(499) (1)

(666) (1)

(54,091) (2)

56,399

(3)

(2,707) (1)

(4,957) (1)

(4,554) (1)

(54,926) (2)

17,494

(4)

106,049 (5)

(5,251) (6)

(225,150) (7)

325,948

(8)

1.19 (8) $

Non-GAAP

116,739

29,169

45,953

659,481

97,531

142,940

58,211

340,519

42,409

260,471

0.95

Non-GAAP %

of Total

Revenue

77.1%

Open Text Confidential. ©2021 All Rights Reserved. 39View entire presentation