Snap Inc Investor Presentation Deck

Snap Inc.

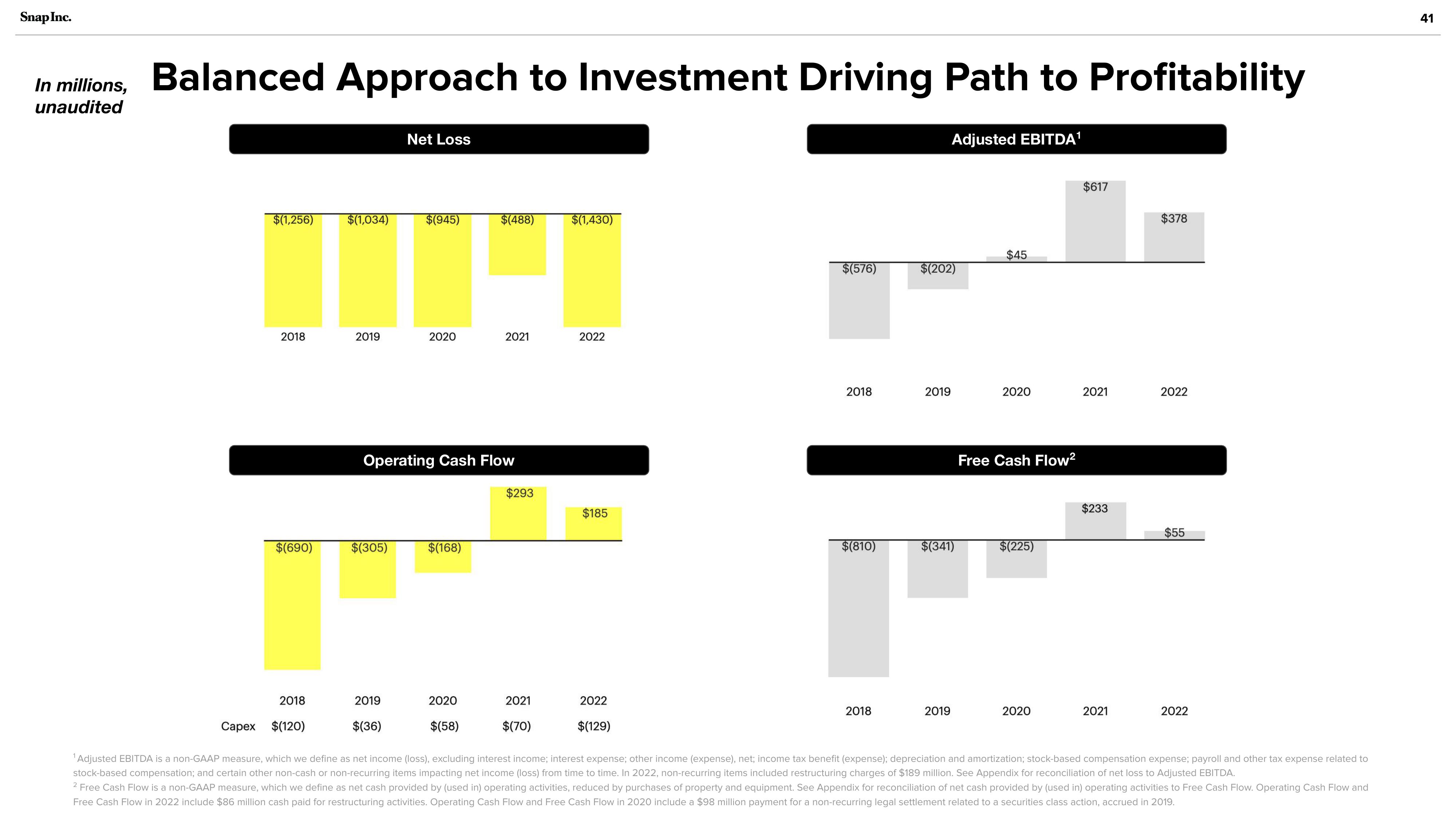

In millions, Balanced Approach to Investment Driving Path to Profitability

unaudited

$(1,256)

2018

$(690)

2018

Capex $(120)

$(1,034)

2019

$(305)

2019

Net Loss

$(36)

$(945)

2020

Operating Cash Flow

$(168)

2020

$(488)

$(58)

2021

$293

2021

$(70)

$(1,430)

2022

$185

2022

$(129)

$(576)

2018

$(810)

2018

Adjusted EBITDA¹

$(202)

2019

$(341)

2019

$45

2020

Free Cash Flow²

$(225)

2020

$617

2021

$233

2021

$378

2022

$55

2022

¹Adjusted EBITDA is a non-GAAP measure, which we define as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to

stock-based compensation; and certain other non-cash or non-recurring items impacting net income (loss) from time to time. In 2022, non-recurring items included restructuring charges of $189 million. See Appendix for reconciliation of net loss to Adjusted EBITDA.

2 Free Cash Flow is a non-GAAP measure, which we define as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. See Appendix for reconciliation of net cash provided by (used in) operating activities to Free Cash Flow. Operating Cash Flow and

Free Cash Flow in 2022 include $86 million cash paid for restructuring activities. Operating Cash Flow and Free Cash Flow in 2020 include a $98 million payment for a non-recurring legal settlement related to a securities class action, accrued in 2019.

41View entire presentation