Pershing Square Activist Presentation Deck

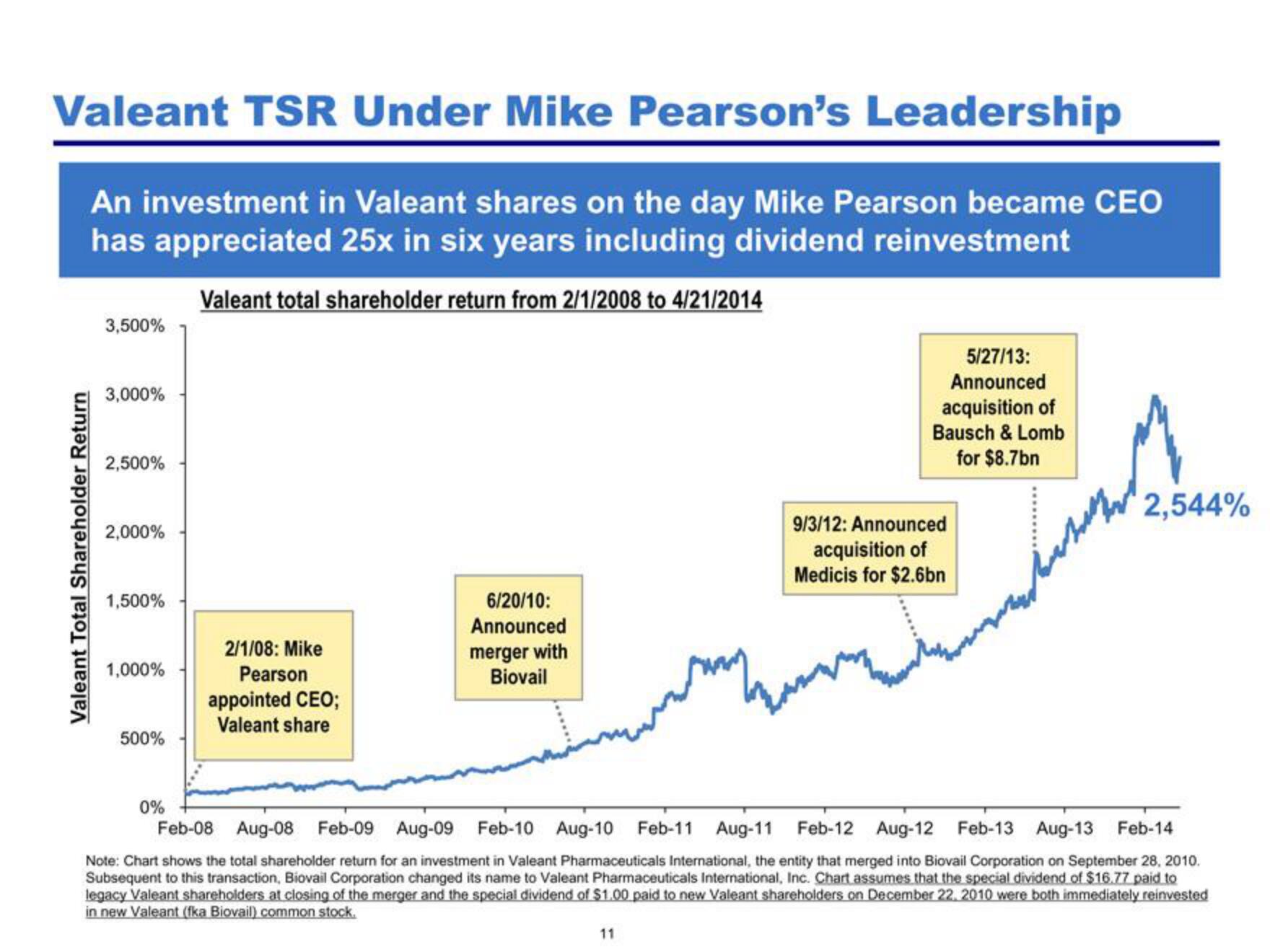

Valeant TSR Under Mike Pearson's Leadership

An investment in Valeant shares on the day Mike Pearson became CEO

has appreciated 25x in six years including dividend reinvestment

Valeant total shareholder return from 2/1/2008 to 4/21/2014

Valeant Total Shareholder Return

3,500%

3,000%

2,500%

2,000%

1,500%

1,000%

500%

2/1/08: Mike

Pearson

appointed CEO;

Valeant share

6/20/10:

Announced

merger with

Biovail

5/27/13:

Announced

acquisition of

Bausch & Lomb

for $8.7bn

11

9/3/12: Announced

acquisition of

Medicis for $2.6bn

2,544%

0%

Feb-08 Aug-08 Feb-09 Aug-09 Feb-10 Aug-10 Feb-11 Aug-11

Feb-12 Aug-12 Feb-13 Aug-13 Feb-14

Note: Chart shows the total shareholder return for an investment in Valeant Pharmaceuticals International, the entity that merged into Biovail Corporation on September 28, 2010.

Subsequent to this transaction, Biovail Corporation changed its name to Valeant Pharmaceuticals International, Inc. Chart assumes that the special dividend of $16.77 paid to

legacy Valeant shareholders at closing of the merger and the special dividend of $1.00 paid to new Valeant shareholders on December 22, 2010 were both immediately reinvested

in new Valeant (fka Biovail) common stock.View entire presentation