Karat IPO Presentation Deck

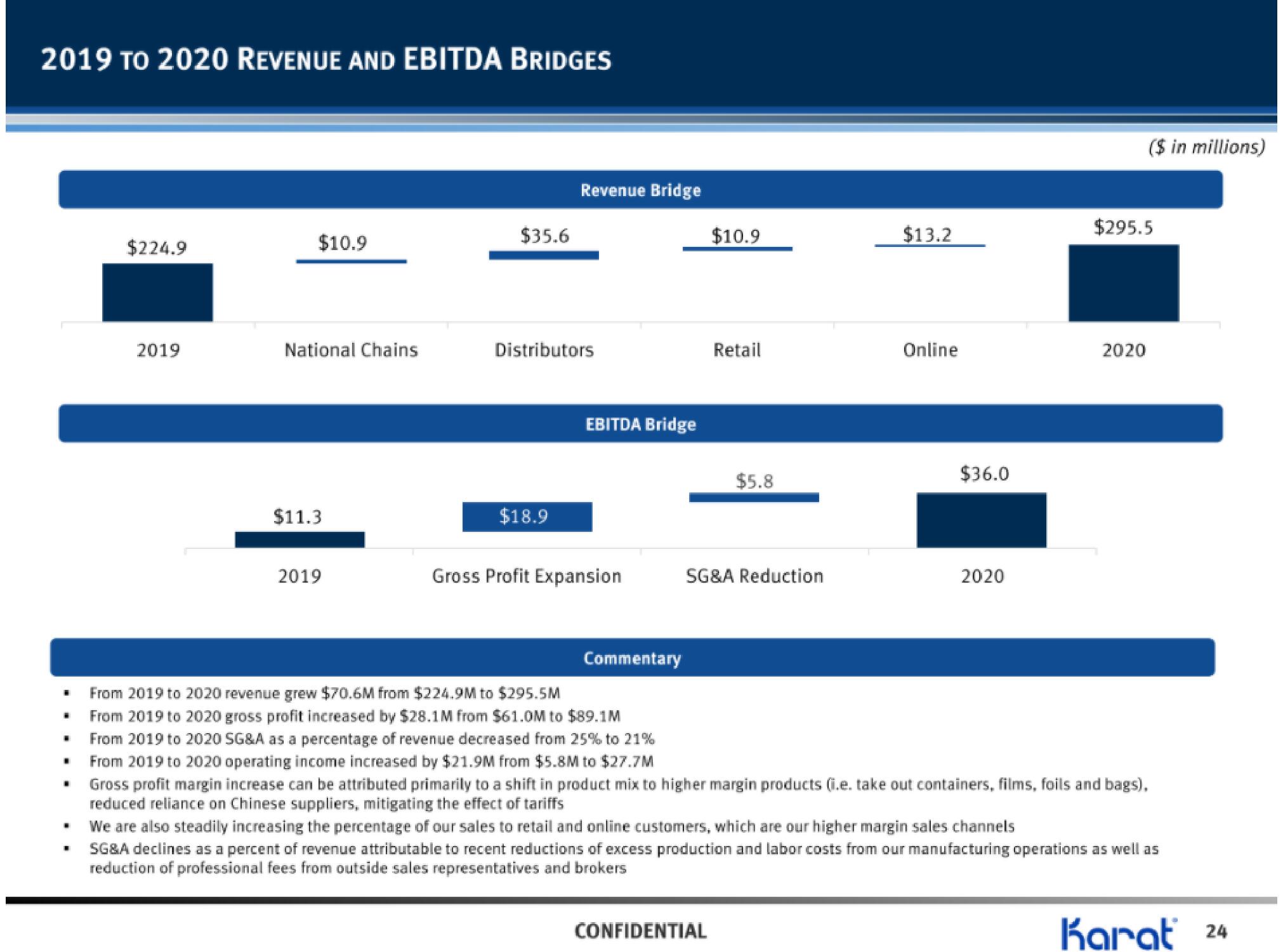

2019 TO 2020 REVENUE AND EBITDA BRIDGES

■

■

$224.9

2019

$10.9

National Chains

$11.3

2019

$35.6

Revenue Bridge

Distributors

$18.9

EBITDA Bridge

Gross Profit Expansion

Commentary

$10.9

Retail

CONFIDENTIAL

$5.8

SG&A Reduction

$13.2

Online

$36.0

2020

($ in millions)

$295.5

2020

From 2019 to 2020 revenue grew $70.6M from $224.9M to $295.5M

From 2019 to 2020 gross profit increased by $28.1M from $61.0M to $89.1M

From 2019 to 2020 SG&A as a percentage of revenue decreased from 25% to 21%

From 2019 to 2020 operating income increased by $21.9M from $5.8M to $27.7M

Gross profit margin increase can be attributed primarily to a shift in product mix to higher margin products (i.e. take out containers, films, foils and bags),

reduced reliance on Chinese suppliers, mitigating the effect of tariffs

We are also steadily increasing the percentage of our sales to retail and online customers, which are our higher margin sales channels

SG&A declines as a percent of revenue attributable to recent reductions of excess production and labor costs from our manufacturing operations as well as

reduction of professional fees from outside sales representatives and brokers

Karat 24View entire presentation