UBS Results Presentation Deck

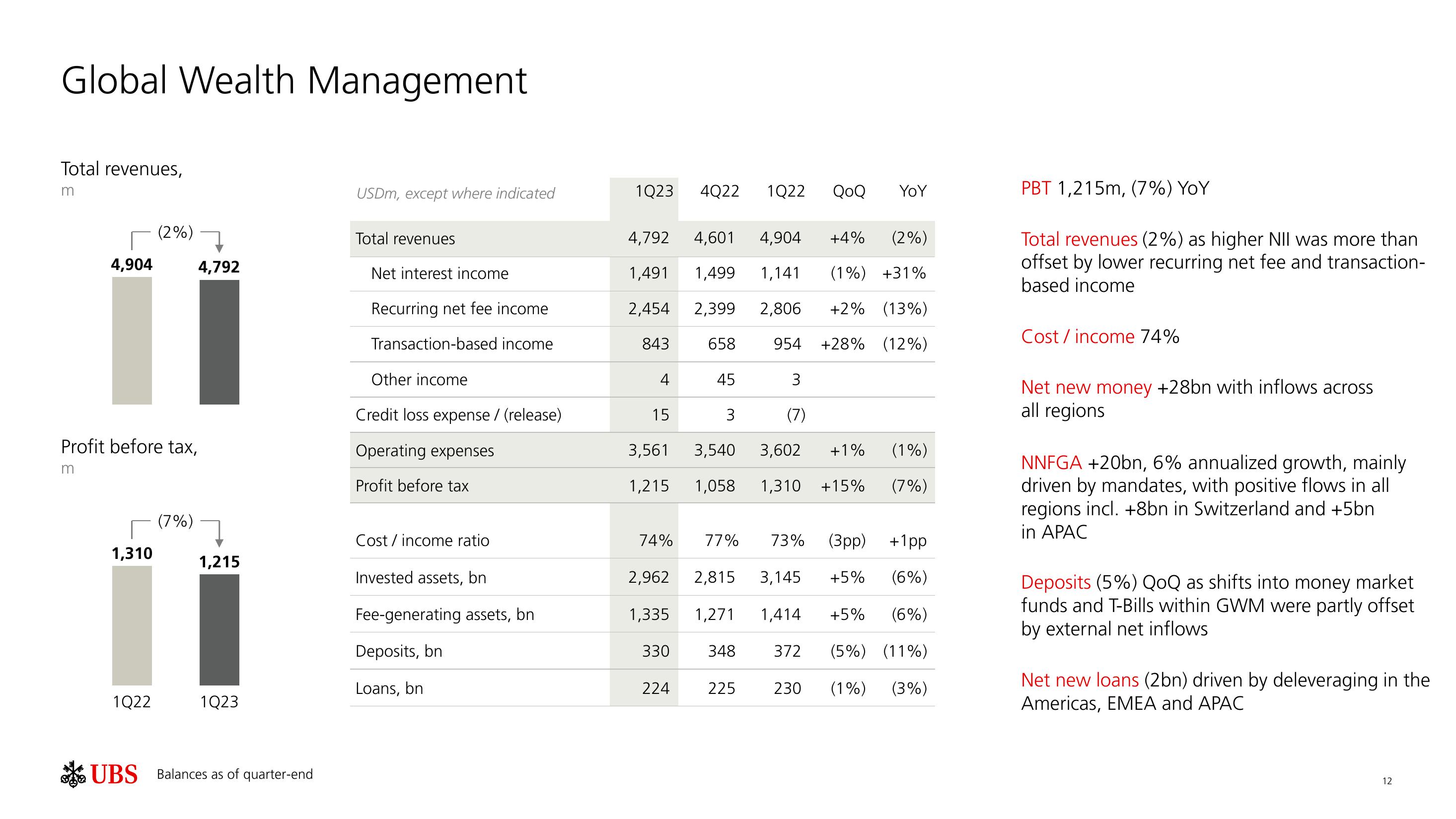

Global Wealth Management

Total revenues,

m

4,904

1,310

(2%)

Profit before tax,

m

1Q22

4,792

(7%)

1,215

1Q23

UBS Balances as of quarter-end

USDm, except where indicated

Total revenues

Net interest income

Recurring net fee income

Transaction-based income

Other income

Credit loss expense / (release)

Operating expenses

Profit before tax

Cost / income ratio

Invested assets, bn

Fee-generating assets, bn

Deposits, bn

Loans, bn

1Q23 4Q22 1Q22 QoQ

4,601 4,904 +4% (2%)

4,792

1,491 1,499 1,141 (1%) +31%

2,454 2,399 2,806 +2% (13%)

843 658 954 +28% (12%)

3

(7)

15

3,561

1,215

74%

45

3

224

YoY

77% 73% (3pp) +1pp

2,962 2,815 3,145 +5% (6%)

1,335 1,271 1,414 +5% (6%)

330 348 372 (5%) (11%)

230 (1%) (3%)

3,540 3,602 +1% (1%)

1,058 1,310 +15% (7%)

225

PBT 1,215m, (7%) YoY

Total revenues (2%) as higher NII was more than

offset by lower recurring net fee and transaction-

based income

Cost/income 74%

Net new money +28bn with inflows across

all regions

NNFGA +20bn, 6% annualized growth, mainly

driven by mandates, with positive flows in all

regions incl. +8bn in Switzerland and +5bn

in APAC

Deposits (5%) QoQ as shifts into money market

funds and T-Bills within GWM were partly offset

by external net inflows

Net new loans (2bn) driven by deleveraging in the

Americas, EMEA and APAC

12View entire presentation