DraftKings Results Presentation Deck

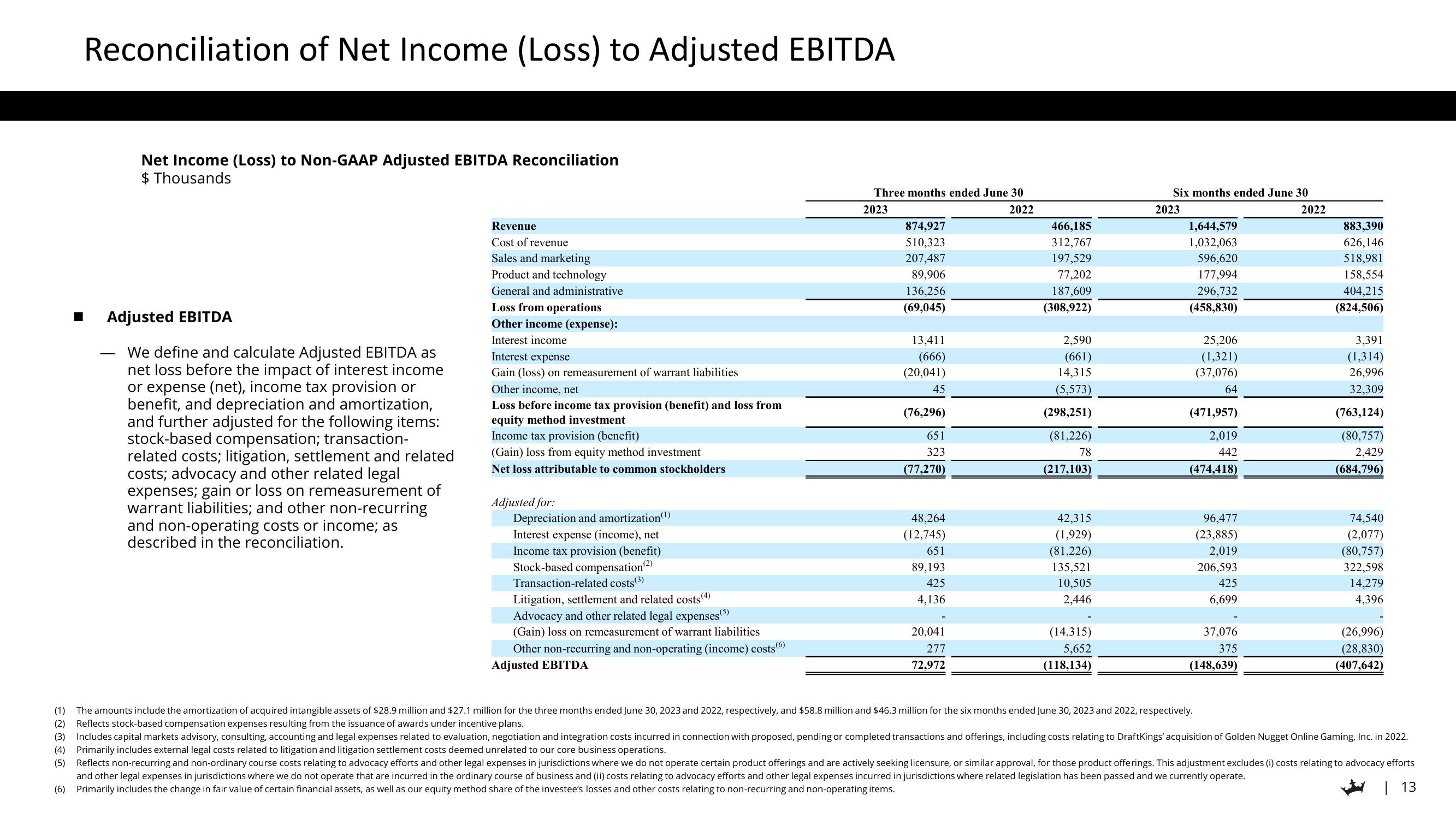

Reconciliation of Net Income (Loss) to Adjusted EBITDA

O

Net Income (Loss) to Non-GAAP Adjusted EBITDA Reconciliation

$ Thousands

Adjusted EBITDA

We define and calculate Adjusted EBITDA as

net loss before the impact of interest income

or expense (net), income tax provision or

benefit, and depreciation and amortization,

and further adjusted for the following items:

stock-based compensation; transaction-

related costs; litigation, settlement and related

costs; advocacy and other related legal

expenses; gain or loss on remeasurement of

warrant liabilities; and other non-recurring

and non-operating costs or income; as

described in the reconciliation.

Revenue

Cost of revenue

Sales and marketing

Product and technology

General and administrative

Loss from operations

Other income (expense):

Interest income

Interest expense

Gain (loss) on remeasurement of warrant liabilities

Other income, net

Loss before income tax provision (benefit) and loss from

equity method investment

Income tax provision (benefit)

(Gain) loss from equity method investment

Net loss attributable to common stockholders

Adjusted for:

Depreciation and amortization (¹)

Interest expense (income), net

Income tax provision (benefit)

Stock-based compensation (²)

Transaction-related costs (3)

Litigation, settlement and related costs (4)

Advocacy and other related legal expenses (5)

(Gain) loss on remeasurement of warrant liabilities

Other non-recurring and non-operating (income) costs

Adjusted EBITDA

(6)

Three months ended June 30

2023

2022

874,927

510,323

207,487

89,906

136,256

(69,045)

13,411

(666)

(20,041)

45

(76,296)

651

323

(77,270)

48,264

(12,745)

651

89,193

425

4,136

20,041

277

72,972

466,185

312,767

197,529

77,202

187,609

(308,922)

2,590

(661)

14,315

(5,573)

(298,251)

(81,226)

78

(217,103)

42,315

(1,929)

(81,226)

135,521

10,505

2,446

(14,315)

5,652

(118,134)

Six months ended June 30

2023

1,644,579

1,032,063

596,620

177,994

296,732

(458,830)

25,206

(1,321)

(37,076)

64

(471,957)

2,019

442

(474,418)

96,477

(23,885)

2,019

206,593

425

6,699

37,076

375

(148,639)

2022

883,390

626,146

518,981

158,554

404,215

(824,506)

3,391

(1,314)

26,996

32,309

(763,124)

(80,757)

2,429

(684,796)

74,540

(2,077)

(80,757)

322,598

14,279

4,396

(26,996)

(28,830)

(407,642)

(1) The amounts include the amortization of acquired intangible assets of $28.9 million and $27.1 million for the three months ended June 30, 2023 and 2022, respectively, and $58.8 million and $46.3 million for the six months ended June 30, 2023 and 2022, respectively.

(2) Reflects stock-based compensation expenses resulting from the issuance of awards under incentive plans.

(3) Includes capital markets advisory, consulting, accounting and legal expenses related to evaluation, negotiation and integration costs incurred in connection with proposed, pending or completed transactions and offerings, including costs relating to DraftKings' acquisition of Golden Nugget Online Gaming, Inc. in 2022.

(4) Primarily includes external legal costs related to litigation and litigation settlement costs deemed unrelated to our core business operations.

(5) Reflects non-recurring and non-ordinary course costs relating to advocacy efforts and other legal expenses in jurisdictions where we do not operate certain product offerings and are actively seeking licensure, or similar approval, for those product offerings. This adjustment excludes (i) costs relating to advocacy efforts

and other legal expenses in jurisdictions where we do not operate that are incurred in the ordinary course of business and (ii) costs relating to advocacy efforts and other legal expenses incurred in jurisdictions where related legislation has been passed and we currently operate.

(6) Primarily includes the change in fair value of certain financial assets, as well as our equity method share of the investee's losses and other costs relating to non-recurring and non-operating items.

| 13View entire presentation